In This Issue

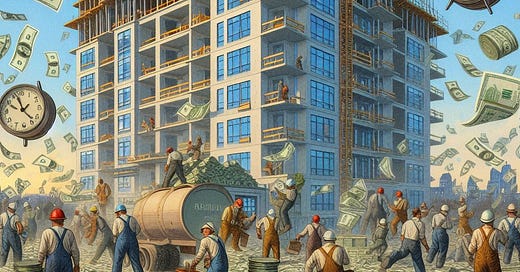

“Time and Money” Housing Policy

This month’s newsletter comes a little late. I was traveling last week to attend a wedding near Chicago. I brought my family with me, and we spent a few days in the city before heading out to the suburbs for the big event.

This trip got me thinking about how much development patterns vary between cities, and how much of that variance is due to somewhat arbitrary, path-dependent housing regulation. Arbitrary in the sense that people across North America aren’t all that different, but somehow the cities where we live all have starkly different rules about how you can build. Path-dependent in the sense that history matters; a given building regulation was often a response to one specific project that was controversial for some reason. Each city will have a different history, leading to its own set of idiosyncratic rules.

In Chicago I saw a bunch of new “missing middle” projects that reminded me of what people were building when I lived in Washington, DC. I’ve now lived in Canada for a few years, so I’m not used to seeing these modes of development anymore. It really struck me that we rarely see these types of projects in Toronto.

This is probably because the regulatory environment in Toronto is particularly difficult for small projects. Even the smallest apartment buildings come with lots and lots of requirements that make them difficult, expensive, or even impossible to build. Many of these rules seem reasonable when you look at them individually, but as a group they prevent productive growth from happening. The rules are optimizing for lots of little things, with no overall prioritization. Things like tree canopy, convenience for utility companies, maximizing revenue for the city, minimizing the visual impact of development, and so on. Of course, we need to ensure that housing development is safe during both construction and occupancy, but those rules are mostly found in building codes, and not in zoning or planning regulations. And so in the middle of a housing crisis, I would argue that it’s high time that the pendulum swung in the other direction, and for rules to be assessed primarily on two measures:

Does this rule increase the time it takes to build a unit of housing?

Does this rule increase the cost to build a unit of housing?

Let me give you an example of a project that I saw in Chicago, which could almost certainly not be built in Toronto. I will also explain why optimizing for time and money makes all the difference at this scale.

Chicago appears to allow this kind of five story building on many single family lots.

Most any contractor who is capable of doing a rear addition should be capable of turning one house into five apartments like this. And it should take a year or less to build.

Let's say a homeowner wants to develop one of these on their property. With $4.00 rents and a 600 sf average unit size, you get:

$4.00 x 600 sf x 5 units x 12 months = $144,000 revenue

Subtract 25% for expenses = $108,000 Net Operating Income

This implies a $2.7MM building value

Let's assume $300 psf hard costs, and $100 psf soft costs on 3,500 gross sf, for a total cost of $1.4MM excluding land (since they already own it).

With a term loan at 75% loan-to-cost, the annual debt service will be around $54,000.

That leaves $54,000 in free cash flow, a 15% return on equity.

With those economics, I am pretty confident that lots of people in Toronto would build these if they could! We often hear that the construction sector is limited by its labor pool, and I think that might be kind of true for large, concrete frame, high-rise projects. But there are lots of contractors who do intensive renovations today and would love to take on this kind of work.

Unfortunately, these buildings are still illegal almost everywhere, whether expressly or because they come burdened with lots of requirements that make them effectively infeasible. Things like tree protection, setbacks, dual egress, elevators, electrical upgrades, minimum soft landscaping... to say nothing of the public consultation that is required for zoning variances.

Even if you were allowed to build these, the economics often wouldn’t work because you can't build cheaply or quickly enough. Your softs might increase by $50 due to taxes/fees and having to make more interest payments because of a longer project schedule. Your hards might increase by $100 because of complex structural framing driven by zoning regulations, unexpected utility conflicts/upgrades, having to install expensive foundations to avoid tree roots, or in monthly fees to the contractor during delays.

The same project, with $150 psf in additional cost, looks like this:

$1,925,000 total cost

$73,000 annual debt service

$35,000 net cash flow

7% return on equity

This project now provides returns similar to the stock market. And stocks don’t require taking development risk or ongoing property management. Long story short, if the costs get too high, these projects simply won’t happen because it’s not worth the trouble.

Now, it’s worth saying that the private sector has plenty of its own work to do in terms of improving productivity.

Not all of this is determined by public policy… but a huge amount of it is. So it bears repeating: Time and Money housing policy is that which measures success by...

1. Minimizing the time to get a unit built, and

2. Minimizing the cost to get a unit built.

We don't really hear about either of these metrics being used by policymakers, but we should! Every level of government should track and report on these metrics, because they are the best two measures of whether we are moving in the right direction.

Is construction getting cheaper or more expensive? Is it getting faster or slower?

Business Updates

I haven’t provided business updates in a few months, largely because a lot of what I’m working on is confidential for now. But I do want to at least attempt to live up to my goal of sharing as much as possible as I build Imprint Development.

First, the losses. We had to walk away from both of our land assemblies this year. We had tied up several parcels on each of two fantastic transit-oriented sites in the City of Toronto. One of them was a very efficient process — we tied up the first property and reached out to the remaining neighbors to make offers to everyone all at once. We quickly discovered that some sellers had extremely unrealistic price expectations, or would not sell at any price. We didn’t want to close on the other properties and take the risk that the assembly might work out in the long run, so we dropped it. The whole thing took just a few months. The second site was more painful. We worked on it for over a year. All of the sellers appeared to be open to a sale, but the process dragged on for too long and as the market continued to decline we couldn’t justify the prices that we had already offered. So we killed the deal.

Second, the wins. If you were an early subscriber, you will know that I’ve always been hesitant to take on too much third-party consulting work. It’s a good way to bring in fees, but Parkinson’s Law stipulates that consulting work will rapidly expand to take up all available time. So I have continued to be selective about when I accept these engagements. Nonetheless, Imprint is gaining a reputation as a nimble development manager that can solve difficult problems. This year we have…

Managed a few files on behalf of private lenders who need to reassess the development potential of sites they took over through foreclosure.

On behalf of the lender, found a buyer for a site that was about to enter into receivership.

Helped other developers think about how to pivot their projects from condominium to rental, which usually involves helping with substantial design changes, equity raising, and changes to financial models.

Raised “rescue capital” that we can deploy to help projects weather the current market. This might mean helping a developer cover their carrying costs, or paying the soft costs required to re-entitle a site that is no longer financially feasible. (If you are a lender or borrower whose project is stuck, please reach out. We can assist with equity, debt, or management services to get projects back on track, particularly under a rental business model.)

There are some other interesting opportunities brewing in the background, and I look forward to sharing more as things materialize.

That’s a wrap.

I write this newsletter because I like to connect with smart people who are doing interesting things. You can reach out by replying to this email.

Thank you for reading, and have a great November.